Engagement ring warranty vs insurance: Navigating the labyrinth of protection for your precious gem requires understanding the subtle yet significant differences. A jeweler’s warranty, often included with the purchase, provides a degree of assurance. However, insurance offers a wider net, covering potential perils beyond the scope of a standard warranty.

This exploration delves into the nuances of each, outlining typical coverage, exclusions, and costs. It will empower you to make an informed decision, safeguarding your cherished engagement ring with a clarity born of understanding.

Introduction to Engagement Ring Protection

Engagement rings, often representing significant investments and sentimental value, require appropriate protection against loss or damage. Understanding the nuances between jeweler’s warranties and insurance policies is crucial for safeguarding this valuable asset. Both mechanisms offer varying degrees of coverage, and choosing the right option depends on individual needs and the specific circumstances surrounding the ring.

Comparison of Warranty and Insurance Coverage

A jeweler’s warranty and insurance policies for jewelry offer distinct approaches to protecting engagement rings. A warranty, typically provided by the retailer, covers specific defects or manufacturing flaws within a defined timeframe. Conversely, insurance policies provide broader coverage against a wider range of potential incidents, but may require a premium payment. The key differences lie in the duration of coverage, the types of events covered, and the exclusions that apply.

| Feature | Warranty | Insurance | Coverage |

|---|---|---|---|

| Coverage Period | Typically limited to a specific timeframe (e.g., one year) after purchase. This period may be shorter for certain types of damage. | Can be customized to cover a specific period (e.g., a year, multiple years, or lifetime) or remain in effect as long as the policy is active and premiums are paid. | The warranty period is finite; the insurance policy, if active, covers the ring for the agreed duration. |

| Covered Events | Usually covers defects in materials or workmanship, such as loose prongs or stones that fall out during normal wear. Limited situations of accidental damage, such as damage during routine cleaning. Typically does not cover damage from theft, loss, or damage from outside forces. | Covers a wider range of incidents, including theft, loss, accidental damage, and even damage from natural disasters. Coverage often extends to specific situations like fire, flood, or other perils, with varying levels of coverage depending on the policy. | Warranties cover manufacturing flaws, whereas insurance policies often cover a broader spectrum of events beyond material defects. |

| Exclusions | Frequently excludes damage caused by negligence, misuse, or alterations. Damage from wear and tear, or from using inappropriate cleaning methods, are often excluded. | May exclude damage caused by intentional acts, or damage from acts of war. The specific exclusions are Artikeld in the policy’s fine print. Exclusions may also depend on the policy’s specific details. | Warranties and insurance policies may have significant exclusions. The exclusions vary considerably between policies. |

Typical Jeweler’s Warranty Coverage

Jeweler’s warranties typically cover manufacturing defects and repair or replacement of the ring. For example, if a stone falls out due to a faulty setting, the warranty may cover the repair or replacement of the stone. However, the coverage is usually limited to the initial defect and does not extend to damages caused by external factors.

Typical Insurance Policy Coverage for Jewelry

Insurance policies for jewelry provide comprehensive coverage, extending beyond manufacturing defects to include a broader range of potential risks. This may include theft, loss, accidental damage, and even damage from environmental factors. For example, an insurance policy might cover the replacement cost of a ring if it’s stolen or damaged in a house fire. Policyholders should carefully review the terms and conditions of their insurance policies to understand the full scope of coverage.

Understanding Warranty Coverage

Engagement ring warranties, while offering some protection, are not comprehensive. A thorough understanding of the specific terms and conditions is crucial to avoid disappointment should a claim be needed. Understanding the exclusions within a warranty is essential to assessing its true value and whether additional protection is necessary.Warranty coverage, often provided by the jeweler, is designed to safeguard the ring from defects or manufacturing issues.

However, these warranties typically have limitations and exclusions that significantly impact the scope of protection. A key aspect is recognizing these limitations to determine if the warranty truly meets your needs.

Common Warranty Exclusions

A significant portion of engagement ring warranties excludes damage caused by factors beyond the scope of normal wear and tear. This includes situations where the ring is mishandled, subjected to extreme conditions, or if the damage is a result of negligence. It’s important to scrutinize the specific language of the warranty to fully understand these limitations. Exclusions often cover circumstances such as misuse, alteration, or repairs performed by unauthorized parties.

Examples of Covered and Uncovered Damage

Warranty coverage varies widely depending on the specific terms. For instance, a stone chipped during a fall might be covered if the fall was accidental and within the scope of the warranty. However, if the stone was chipped due to deliberate impact or a significant drop, the warranty may not apply. Damage from normal wear and tear, like minor scratches from daily use, typically falls outside the scope of coverage.

Damage caused by exposure to harsh chemicals or significant environmental factors, such as prolonged exposure to extreme heat or moisture, are also usually excluded.

While an engagement ring warranty covers manufacturing defects, insurance often steps in for accidental damage or loss. Think of it like this: a warranty is a safety net for the ring’s integrity, while insurance is a broader safeguard, especially if you’re worried about the penalties for driving uninsured in Texas, which can be quite hefty. penalty for no insurance in texas Ultimately, both offer crucial protection, but their scope and coverage differ significantly, making a careful comparison essential for your peace of mind when it comes to your precious ring.

Table of Warranty Coverage Scenarios

| Type of Damage | Warranty Coverage (Typical) |

|---|---|

| Accidental Damage (e.g., a fall) | Potentially covered if the fall is not deemed misuse or negligence; specific terms vary. |

| Normal Wear and Tear (e.g., minor scratches) | Generally not covered. |

| Loss or Theft | Usually not covered unless explicitly stated in the warranty terms. |

| Damage from improper cleaning methods | Generally not covered. |

| Damage from excessive force or misuse | Generally not covered. |

| Manufacturing defects | Often covered; however, specific definitions and timelines vary. |

Insurance for Engagement Rings

Insuring an engagement ring offers a crucial layer of protection beyond the manufacturer’s warranty. This additional safeguard addresses potential risks not covered by standard warranties, such as accidental damage, theft, or loss. Understanding the nuances of jewelry insurance is essential for making informed decisions about safeguarding this significant investment.

Insuring an Engagement Ring: The Process

The process of insuring an engagement ring typically involves several key steps. First, an appraisal is conducted to determine the ring’s current market value. This valuation considers the quality of the gemstones, the metal type, and the craftsmanship. A detailed description of the ring, including specifications like carat weight, clarity, and cut of the gemstones, is crucial for accurate assessment.

Secondly, a thorough inventory of the ring’s components is documented. This includes details about any accompanying jewelry, such as earrings or bracelets. The insurance policy will then be tailored to the specific characteristics and value of the ring, covering various potential perils. Finally, payment for the insurance premium is made, and the insured party is notified about the coverage details and any necessary documentation.

Different Types of Jewelry Insurance Policies

Various types of jewelry insurance policies cater to diverse needs and budgets. Standard policies typically cover damage, theft, and loss. Some policies offer broader coverage, including accidental damage or even specific events like a house fire. High-value policies may offer enhanced coverage and higher payout limits, especially crucial for rare or exceptionally valuable gemstones. Furthermore, some policies allow for the replacement of lost or damaged items, often within a reasonable timeframe.

Policies may also cover repairs or restoration costs if the damage can be repaired, rather than just a replacement. Specialized policies may address specific risks like water damage or even damage from certain environmental conditions. It’s essential to carefully review policy terms and conditions to understand the extent of coverage and exclusions.

Comparison of Warranty and Insurance Costs

| Factor | Warranty | Insurance |

|---|---|---|

| Premium Cost | Typically, no additional cost beyond the purchase price. | A recurring premium, often calculated as a percentage of the ring’s appraised value. Premiums vary based on factors such as the ring’s value, coverage limits, and deductible. |

| Coverage Limits | Limited to manufacturer defects and typically does not cover accidental damage, loss, or theft. | Tailored to the ring’s value and can be customized to include theft, loss, damage, and even accidental damage. Coverage limits can be substantial and often adjustable. |

| Deductibles | Not applicable in most cases; if applicable, the amount is typically minimal and absorbed within the warranty terms. | A deductible amount is typically included, representing the amount the insured must pay before the insurance company covers any costs. The deductible can be substantial, and the choice of deductible often influences the premium cost. |

A crucial consideration is that warranties primarily protect against manufacturing flaws, while insurance policies address a wider spectrum of potential risks. The cost-benefit analysis of insurance must consider the perceived risk of loss or damage and the ring’s value relative to the premium. Insurance, therefore, provides a financial safeguard beyond the warranty’s limited scope, offering a more comprehensive protection against unexpected events.

Protecting your sparkly new bling is key! Engagement ring warranties, while helpful, often have limitations. Considering insurance alongside a warranty might be a smarter move, especially if you’re looking for comprehensive coverage. For a taste of something totally different, check out Antonio’s Pizza menu in Brunswick, Ohio, Antonio’s pizza menu brunswick ohio. Ultimately, comparing your options for an engagement ring warranty versus insurance is crucial for peace of mind, regardless of whether you’re craving a pepperoni pizza or a perfect diamond.

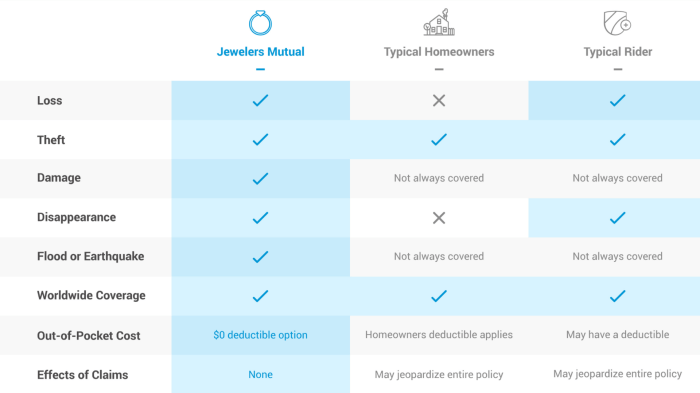

Comparing Warranty and Insurance: Engagement Ring Warranty Vs Insurance

Engagement ring protection often involves a choice between manufacturer warranty and insurance policies. Both aim to safeguard the investment, but their scope, coverage, and associated costs differ significantly. Understanding these nuances is crucial for making an informed decision.A warranty, typically provided by the retailer or jeweler, offers limited protection against defects in materials or workmanship. Insurance, on the other hand, is a broader safeguard against a wider array of potential risks, including loss or damage.

Warranty Coverage Analysis

Warranties are typically straightforward, covering issues arising from manufacturing flaws. The coverage period is often predetermined and limited to specific defects. For example, a one-year warranty might cover a loose stone or a faulty setting, but not necessarily damage caused by accidental impact. This inherent limitation necessitates careful consideration of the warranty’s terms.

Insurance Policy Evaluation

Insurance policies, conversely, offer more comprehensive protection. They address a broader range of potential risks, including theft, loss, damage from accidental impact, and even natural disasters. A comprehensive policy might cover not only the ring’s intrinsic value but also potential future appraisal increases.

Comparative Analysis of Benefits and Drawbacks

| Feature | Warranty | Insurance |

|---|---|---|

| Coverage Scope | Limited to manufacturing defects. | Broader, encompassing loss, damage, and theft. |

| Cost | Usually free or minimal. | Premiums vary based on policy terms and ring value. |

| Duration | Typically limited to a specific period. | Renewable, offering continuous protection. |

| Claims Process | Often straightforward, following retailer guidelines. | Requires following insurance policy procedures, potentially involving appraisal. |

| Exclusions | Significant exclusions may exist. | Policies may contain exclusions, but usually with fewer restrictions than warranties. |

Situations Favoring Each Option

A warranty is often sufficient for minor manufacturing issues expected within a short period. Insurance is generally preferable when considering risks like theft or accidental damage. A thorough assessment of the individual risk profile is critical.

Factors in Choosing Between Warranty and Insurance

Several factors should be considered:

- Risk Tolerance: Individuals with a higher tolerance for risk may find a warranty sufficient, while those averse to potential losses might prefer insurance.

- Ring Value: For high-value rings, insurance offers a greater level of financial protection.

- Potential for Damage: If the ring is likely to be exposed to high-risk situations (e.g., active lifestyle), insurance may be more prudent.

- Coverage Gaps: A comprehensive evaluation of potential coverage gaps within a warranty is crucial.

Questions to Ask When Purchasing Insurance, Engagement ring warranty vs insurance

Comprehensive inquiries are crucial when purchasing insurance.

- Coverage Limits: The policy’s maximum payout should be clearly understood.

- Exclusions: Specific circumstances that are not covered should be noted.

- Claims Process: The policy should detail the procedures involved in filing a claim.

- Renewal Terms: The renewal process and associated costs should be Artikeld.

- Appraisal Requirements: The insurer’s appraisal process and associated fees should be transparent.

Illustrative Scenarios

Choosing between warranty and insurance for an engagement ring depends heavily on individual circumstances and the potential risks associated with specific lifestyles and situations. A comprehensive understanding of both options is crucial for making an informed decision. This section presents illustrative scenarios to highlight when a warranty might be sufficient and when insurance offers superior protection.

Warranty Sufficiency Scenarios

Warranties, typically offered by jewelers, provide coverage for defects in materials or workmanship within a specific timeframe. They are often sufficient for routine maintenance or minor repairs.

- Low-Risk Lifestyle: A professional with a desk job who rarely exposes their ring to significant wear and tear. A warranty may cover potential issues like a loose stone or a minor scratch from everyday use. Routine professional cleaning and storage are key for maintaining warranty coverage.

- Limited Exposure to Hazards: A person living in a relatively stable environment with minimal risk of theft or damage. The warranty’s coverage might suffice for accidental damage, but theft or damage beyond normal wear and tear would not be covered.

- Minimal Outdoor Activities: Someone who primarily wears their ring indoors and avoids high-impact activities or exposure to extreme temperatures or chemicals. In these cases, a warranty can be adequate for most common issues.

Insurance as a Superior Choice

Insurance provides broader coverage than a warranty, extending to incidents not covered by the standard warranty, such as theft, loss, and accidental damage. It is generally a better option for individuals with higher risk profiles.

- High-Risk Lifestyle: An individual with an active lifestyle, frequently engaging in outdoor activities like hiking or sports. Insurance is recommended to cover potential damage or loss due to accidents. A warranty might not cover damage from a fall or impact.

- Valuable Gemstones: A ring featuring rare or high-value gemstones. Insurance coverage can protect the investment in the ring if it is damaged or lost. A warranty might not adequately compensate for the loss of such a valuable gem.

- Frequent Travel: Someone who frequently travels to high-risk areas or participates in activities where the ring is at greater risk. Insurance can protect the ring from loss or damage in these situations. A warranty likely would not cover theft or damage while traveling.

- High-Value Rings: An engagement ring with significant monetary value. Insurance can provide substantial financial compensation in the event of theft or damage, exceeding the limitations of a warranty. A warranty typically has limited payout amounts.

Choosing the Right Protection

The best protection for an engagement ring is contingent upon the individual’s lifestyle and the ring’s value. Comprehensive evaluation of the potential risks and a thorough comparison of the coverage options are crucial.

| Lifestyle Factor | Warranty Adequacy | Insurance Necessity |

|---|---|---|

| Sedentary Lifestyle | Likely sufficient | Less critical |

| Active Lifestyle | Potentially insufficient | More essential |

| High-Value Gemstones | Potentially insufficient | Highly recommended |

| Frequent Travel | Potentially insufficient | Highly recommended |

Choosing the right protection is crucial for safeguarding a valuable investment.

Practical Advice for Choosing Protection

Determining the appropriate level of protection for an engagement ring requires careful consideration of its inherent value and potential risks. This section provides practical advice on evaluating the ring’s worth for insurance purposes, handling potential damage or loss, and maintaining crucial documentation. A well-defined strategy for protection minimizes financial and emotional distress in unforeseen circumstances.

Determining the Value of Your Engagement Ring for Insurance

Accurate valuation is paramount for appropriate insurance coverage. Methods for establishing the ring’s value include appraisal by a qualified gemologist or jeweler, market research using comparable sales of similar rings, and consideration of the ring’s materials (metal type, stone type and quality). A professional appraisal provides a formal documentation of the ring’s characteristics and value, crucial for insurance claims.

This documentation often includes details such as the stone’s carat weight, cut, clarity, and color, along with the metal’s type and quality. Consider the ring’s historical significance or sentimental value; these elements might influence its overall worth, particularly for heirloom rings.

Steps to Take When a Ring is Damaged or Lost

Prompt action following damage or loss is essential for mitigating potential financial losses. Immediately document the incident with photos, videos, and detailed written accounts. This comprehensive record will be vital for insurance claims and will preserve evidence of the ring’s condition before the incident. Report the loss or damage to the appropriate authorities, such as the police, if applicable.

Contact your insurance provider and the jeweler immediately to initiate the claims process. Seek legal counsel if necessary, especially if the loss or damage involves a dispute or legal implications.

Maintaining Proper Documentation

Comprehensive documentation of your ring’s history and condition is crucial for safeguarding its value. This involves retaining the original sales receipt or invoice, as well as any subsequent repair records. A well-maintained record provides a detailed history of the ring’s ownership, original condition, and any modifications or repairs. These records are critical in case of disputes or claims.

Storing these documents in a secure location, like a fireproof safe or a secure digital archive, ensures their preservation and accessibility. Consider photographing the ring in its original condition and documenting the appearance of any repairs performed. Maintain copies of all documents and store them separately from the original documents to safeguard against loss or damage. Regularly reviewing and updating these records helps ensure their accuracy and completeness.

Last Word

In conclusion, choosing between a warranty and insurance for your engagement ring depends heavily on your individual circumstances. A comprehensive understanding of the specifics of each option, including coverage limits and exclusions, allows for a decision aligned with your needs and financial situation. Ultimately, the goal is to protect your investment and ensure the enduring brilliance of this significant symbol.

FAQ Section

What are common exclusions in an engagement ring warranty?

Common exclusions include damage from normal wear and tear, intentional damage, and loss or theft outside of the jeweler’s premises. Refer to the specific warranty terms.

How does jewelry insurance differ from a warranty?

Insurance typically covers a wider range of perils, including loss, theft, and damage from accidental causes, often beyond the scope of a standard warranty. Insurance policies also generally offer replacement or repair coverage based on the assessed value of the ring.

What factors influence the cost of insurance for an engagement ring?

Factors like the ring’s appraised value, the type of coverage, the deductible, and the policy’s duration will affect the insurance premium. Consider a comprehensive policy for the most protection.

What steps should I take if my engagement ring is damaged?

First, document the damage thoroughly. Contact the jeweler or insurance company to initiate the claim process. Follow their specific instructions for reporting the incident.