Do all Medicare Advantage plans have a donut hole? Understanding this crucial aspect of Medicare coverage is essential for navigating the complexities of healthcare costs. This comprehensive guide provides a clear explanation of Medicare Advantage plans, their prescription drug coverage, and how they relate to the notorious “donut hole” in Original Medicare.

Medicare Advantage plans, often touted as a streamlined alternative to Original Medicare, offer a variety of benefits, including doctor visits, hospital care, and prescription drugs. However, the way they handle prescription drug coverage, and whether or not they incorporate a “donut hole,” varies significantly between plans. This article will help you understand these crucial differences and how they impact your out-of-pocket costs.

Medicare Advantage Plans and Coverage

Medicare Advantage plans are private health insurance plans offered by companies approved by Medicare to provide comprehensive healthcare coverage to beneficiaries. These plans are an alternative to Original Medicare, offering additional benefits and often lower monthly premiums. They are designed to provide a more convenient and integrated healthcare experience.Medicare Advantage plans typically include a range of services beyond those covered under Original Medicare, such as vision, hearing, and dental care, and some plans also include prescription drug coverage.

These plans aim to make healthcare more accessible and affordable for Medicare beneficiaries by combining various services under one umbrella.

Medicare Advantage Plan Types

Medicare Advantage plans are categorized into different types, each offering varying benefits. Understanding these types helps beneficiaries choose the plan that best suits their individual needs. This section describes the various plan types.

- Health Maintenance Organizations (HMOs): HMOs typically require beneficiaries to choose a primary care physician (PCP) within their network. This PCP coordinates care and manages referrals to specialists within the network. HMOs generally have lower premiums than other plan types, but beneficiaries may face restrictions on choosing healthcare providers outside the network.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs. Beneficiaries can choose doctors and specialists both inside and outside the network, though care outside the network may incur higher costs. PPOs typically have higher premiums than HMOs but provide greater freedom in healthcare provider selection.

- Private Fee-for-Service (PFFS) Plans: These plans allow beneficiaries to choose any doctor or specialist, regardless of whether they are in-network. Beneficiaries have more control over their healthcare decisions but may face higher costs for out-of-network care. PFFS plans generally have higher premiums compared to HMOs and PPOs.

Benefits Offered in Medicare Advantage Plans

Medicare Advantage plans offer a variety of benefits beyond the basic coverage of Original Medicare. These plans often include benefits not found in Original Medicare, such as vision, hearing, and dental care.

- Vision care: Some plans include routine eye exams, glasses, and other vision-related services. This coverage can be crucial for seniors, addressing common eye health concerns.

- Hearing care: Similarly, some plans provide coverage for hearing exams and hearing aids, enhancing the quality of life for beneficiaries with hearing loss.

- Dental care: Dental care, including checkups and cleanings, is sometimes covered, improving oral health.

Relationship Between Medicare Advantage and Original Medicare, Do all medicare advantage plans have a donut hole

Medicare Advantage plans operate in conjunction with Original Medicare. Beneficiaries enrolled in a Medicare Advantage plan are still enrolled in Original Medicare, but their healthcare services are primarily managed through the Advantage plan.

Comparison of Medicare Advantage and Original Medicare

Medicare Advantage plans and Original Medicare differ significantly in their coverage and benefits. This comparison highlights the key distinctions.

Hmm, do all Medicare Advantage plans have a donut hole? It’s a tricky question, isn’t it? Finding dog friendly accommodation in Margaret River, for example, dog friendly accommodation in Margaret River often involves navigating different policies. Similarly, Medicare plans can vary greatly, and while some have them, others don’t. So, the answer to the original question depends on the specific plan.

It’s a bit like a spiritual journey, really. The details are key, and you need to investigate further to be sure. So, not all Medicare Advantage plans feature a donut hole, in short.

| Plan Type | Coverage of Doctor Visits | Coverage of Prescription Drugs |

|---|---|---|

| Medicare Advantage | Generally includes doctor visits within the plan’s network. Out-of-network care may be limited or subject to higher costs. | Prescription drug coverage is often included as a benefit, but the specific coverage varies widely. |

| Original Medicare | Covers doctor visits, but may have cost-sharing such as deductibles and co-pays. | Prescription drug coverage is not included; it requires a separate Medicare Part D plan. |

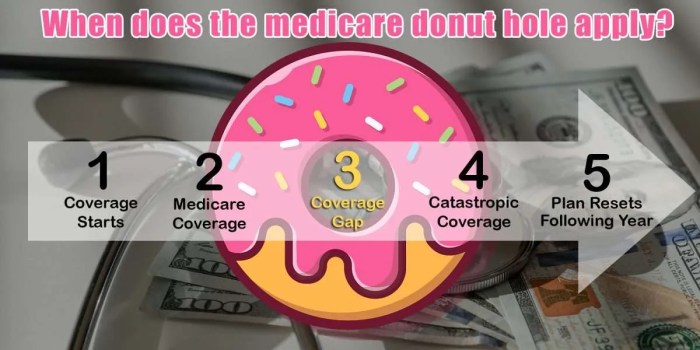

The “Donut Hole” in Medicare

The Medicare Part D prescription drug benefit, while offering crucial coverage, includes a “donut hole” provision. This gap in coverage is a significant aspect of the program, and understanding its structure and impact is essential for beneficiaries. The donut hole phase is designed to gradually increase out-of-pocket costs for certain prescription drugs after a beneficiary has used a specific amount of coverage.The “donut hole” in Medicare Part D prescription drug coverage is a period where beneficiaries face higher out-of-pocket costs for covered medications.

This provision is intended to help control costs by gradually increasing beneficiary responsibility for prescription drug expenses after they have reached a certain level of coverage. This phased approach is intended to create an incentive for beneficiaries to utilize cost-effective medications and potentially avoid unnecessary prescriptions.

Description of the Donut Hole

The donut hole is a specific period of coverage under Medicare Part D where beneficiaries shoulder a substantial portion of the cost for their prescription drugs. It’s a gap in coverage between the initial coverage period and the catastrophic coverage phase. This stage is designed to balance cost-effectiveness and ensure the sustainability of the prescription drug benefit.

Impact on Beneficiaries

The donut hole impacts beneficiaries by increasing their out-of-pocket expenses for prescription drugs. This can be a substantial financial burden for those who rely on prescription medications for chronic conditions. The unpredictability of costs associated with this phase can cause significant financial strain and potential for medication non-adherence.

Stages of the Donut Hole and Associated Costs

The donut hole is divided into distinct phases. Understanding these phases and the corresponding out-of-pocket costs helps beneficiaries anticipate and prepare for the increased expenses.

- Initial Coverage Phase: Beneficiaries pay a small percentage of the cost for their prescription drugs. This initial phase is designed to provide an entry point for beneficiaries to utilize covered medications and ensure they have access to affordable treatment in the early stages of the coverage.

- Coverage Gap/Donut Hole Phase: This is the critical phase where beneficiaries pay a substantial portion of the cost for their prescription drugs. The percentage varies yearly, as determined by legislation, and impacts beneficiaries in significant ways. This period is characterized by a marked increase in out-of-pocket costs, representing the coverage gap within the benefit structure. The beneficiary’s cost-sharing gradually increases until reaching the coverage gap threshold.

- Catastrophic Coverage Phase: In this phase, the cost-sharing for covered prescription drugs decreases substantially, and the beneficiary pays a significantly lower percentage of the cost. This phase is intended to provide comprehensive coverage when expenses reach a certain threshold, thus safeguarding beneficiaries against excessive out-of-pocket costs for their medications.

Step-by-Step Explanation of the Donut Hole

The donut hole begins when a beneficiary reaches a certain amount of out-of-pocket spending for prescription drugs. This threshold is established annually and adjusted to account for inflationary factors and changes in drug costs. The percentage of the cost-sharing the beneficiary pays gradually increases as their out-of-pocket costs reach a predetermined level. Once the beneficiary’s out-of-pocket expenses reach the catastrophic coverage threshold, the coverage phase shifts into the catastrophic coverage phase.

Donut Hole Cost-Sharing Table

| Phase | Description | Cost-Sharing Percentage |

|---|---|---|

| Initial Coverage Phase | Beneficiary pays a small percentage of drug costs. | Low percentage, varying annually. |

| Donut Hole Phase | Beneficiary pays a large percentage of drug costs. | Significant percentage, varying annually. |

| Catastrophic Coverage Phase | Beneficiary pays a low percentage of drug costs. | Low percentage, significantly less than the donut hole. |

Medicare Advantage Plans and Prescription Drug Coverage

Medicare Advantage plans, offered as an alternative to Original Medicare, often include prescription drug coverage. Understanding how these plans handle prescription drugs is crucial for beneficiaries making informed decisions about their healthcare. This section will detail how Medicare Advantage plans manage prescription drug coverage, addressing the “donut hole” and comparing costs to Original Medicare’s Part D.Medicare Advantage plans typically incorporate prescription drug coverage within the plan’s overall benefits.

This coverage can vary significantly between different plans, affecting the extent of benefits and the out-of-pocket costs for beneficiaries.

Prescription Drug Coverage in Medicare Advantage Plans

Medicare Advantage plans incorporate prescription drug coverage as a component of the broader plan. The extent and specifics of this coverage are Artikeld in the plan’s benefit documents. Plans may have various tiers or levels of coverage, and the cost-sharing responsibilities can differ.

Medicare Advantage Plans and the “Donut Hole”

Medicare Advantage plans are not automatically exempt from the “donut hole” provisions, which are a feature of Medicare Part D prescription drug coverage. The “donut hole” is a gap in coverage where beneficiaries pay a greater share of prescription drug costs. The coverage and specific cost-sharing within a Medicare Advantage plan will vary by plan. It is crucial for beneficiaries to review the plan’s specific formulary, which is a list of covered drugs, and the cost-sharing structure to understand their coverage.

Not all plans will have the same coverage.

Similarities and Differences Between Medicare Advantage and Original Medicare Part D

Medicare Advantage plans and Original Medicare’s Part D both offer prescription drug coverage, but their structures differ. Both plans require beneficiaries to choose a plan, and both plans may require a monthly premium, and some co-pays, co-insurance, and deductibles. A significant difference lies in the administrative structure; Medicare Advantage plans are managed by private insurance companies, whereas Part D is managed by the federal government.

Further, the specific formulary of covered drugs can differ between plans, as can the cost-sharing.

Out-of-Pocket Costs for Prescription Drugs

Out-of-pocket costs for prescription drugs in Medicare Advantage plans can differ substantially from those in Original Medicare’s Part D. The extent of coverage and cost-sharing provisions within each plan will vary. Beneficiaries should carefully examine the plan documents to understand the specific cost-sharing responsibilities, including deductibles, co-pays, and co-insurance.

Comparison of Typical Out-of-Pocket Costs

| Coverage Type | Initial Cost-Sharing (Example) | Donut Hole Stage (Example) | Coverage After Donut Hole (Example) |

|---|---|---|---|

| Medicare Advantage Plan A | $10 per prescription (co-pay) | $300 per prescription | $10 per prescription (co-pay) |

| Medicare Advantage Plan B | $20 per prescription (co-pay) | $400 per prescription | $5 per prescription (co-pay) |

| Original Medicare Part D | $40 per prescription (co-pay) | $450 per prescription | $10 per prescription (co-pay) |

Note: These are illustrative examples, and actual costs can vary greatly depending on the specific plan, the prescription drug, and the beneficiary’s utilization. Beneficiaries should carefully review the plan documents for detailed information.

Variations in Medicare Advantage Plans

Medicare Advantage plans, while offering comprehensive coverage beyond basic Medicare, exhibit significant variations in their specific benefits. This diversity encompasses crucial aspects, including prescription drug coverage, which plays a vital role in managing healthcare costs for beneficiaries. Understanding these differences is essential for making informed decisions when choosing a plan.Prescription drug coverage within Medicare Advantage plans varies substantially.

This variance is not a random occurrence but is influenced by factors that shape the plan’s design and financial considerations. A detailed examination of these influencing factors is critical for navigating the complexities of plan selection.

Prescription Drug Coverage Variations

Medicare Advantage plans offer varying levels of prescription drug coverage, impacting the extent to which beneficiaries can afford their medications. The specific drug formulary, co-pays, and out-of-pocket maximums are key elements in determining a plan’s affordability and overall value. A comprehensive understanding of these details is necessary to make an appropriate choice.

Factors Influencing Prescription Drug Coverage

Several factors influence the extent of prescription drug coverage in Medicare Advantage plans. These include the plan’s specific formulary, which lists the covered drugs, and the negotiated pricing with pharmaceutical companies. Further factors are the plan’s actuarial considerations, the specific health needs of the targeted population, and the plan’s financial stability.

Importance of Checking Plan Details

Carefully reviewing the specific details of a Medicare Advantage plan’s prescription drug coverage is crucial for beneficiaries. This involves examining the formulary to ensure coverage for essential medications. Beneficiaries should also scrutinize co-pays, deductibles, and out-of-pocket maximums to anticipate potential costs. This thorough assessment ensures the chosen plan aligns with individual needs and financial capabilities.

Identifying the “Donut Hole” Structure

Each Medicare Advantage plan may have its own structure for prescription drug coverage. To determine if a plan has its own “donut hole” structure, beneficiaries must review the plan’s Summary of Benefits and Coverage (SBC). The SBC document provides a detailed overview of the plan’s prescription drug coverage, including the specific details of its coverage gaps.

Table Illustrating Differences in Prescription Drug Coverage

| Plan Name | Formulary Description | Co-pay (Generic) | Co-pay (Brand Name) | Out-of-Pocket Maximum |

|---|---|---|---|---|

| Plan A | Comprehensive formulary covering most common medications | $10 | $25 | $4,000 |

| Plan B | Narrower formulary, with limited coverage for specialty medications | $5 | $20 | $3,500 |

| Plan C | Focuses on preferred generic medications | $2 | $15 | $5,000 |

Note: This table provides examples. Actual plans may vary considerably. Always refer to the plan’s Summary of Benefits and Coverage (SBC) for the most accurate information.

Medicare Advantage Plans and the “Donut Hole” – Examples

Medicare Advantage plans offer a variety of prescription drug coverage options, some with and without the “donut hole” structure. Understanding these variations is crucial for beneficiaries to make informed decisions about their healthcare choices. These plans often differ in their approaches to covering prescription drugs, which can impact out-of-pocket expenses and overall cost effectiveness.Medicare Advantage plans frequently offer various approaches to prescription drug coverage, impacting beneficiaries’ out-of-pocket costs.

The presence or absence of a “donut hole” significantly influences the amount a beneficiary pays for prescription drugs. Some plans completely eliminate the “donut hole,” providing a more predictable and potentially lower overall cost structure. Conversely, plans that incorporate a “donut hole” structure feature a tiered approach to coverage, impacting out-of-pocket costs at specific drug cost levels.

Medicare Advantage Plans with Prescription Drug Coverage Outside the “Donut Hole”

Many Medicare Advantage plans include prescription drug coverage that extends beyond the traditional “donut hole” structure. These plans often offer comprehensive coverage that avoids the gap in coverage typically associated with the “donut hole.” This can provide greater financial security for beneficiaries. Examples of such plans often incorporate various approaches, including higher monthly premiums in exchange for greater coverage.

Beneficiaries should carefully evaluate the total cost, including monthly premiums and out-of-pocket expenses, to ensure that the overall plan is cost-effective.

Medicare Advantage Plans Without a “Donut Hole” Structure for Drugs

Some Medicare Advantage plans opt to eliminate the “donut hole” structure for prescription drugs. This approach provides continuous coverage at a consistent level. These plans aim to offer a more predictable and potentially lower overall cost structure. The absence of a “donut hole” generally leads to lower out-of-pocket costs for beneficiaries during the higher-cost drug phases, but often comes with a higher monthly premium.

Beneficiaries must weigh the higher premiums against the potential savings during the higher-cost phases.

Impact on Beneficiaries’ Out-of-Pocket Costs

The presence or absence of a “donut hole” significantly affects beneficiaries’ out-of-pocket costs. Plans without a “donut hole” typically result in lower out-of-pocket expenses during the higher-cost drug phases. In contrast, plans with a “donut hole” structure will require beneficiaries to pay a greater portion of their prescription drug costs during the coverage gap. These cost differences should be considered when comparing plans and selecting a Medicare Advantage plan.

Hmm, do all Medicare Advantage plans have a donut hole? It’s a bit complex, isn’t it? To understand the specifics, exploring insurance companies in Jackson, MS, like these ones , might be helpful. They can provide details on various plans, including whether or not they have a coverage gap. Ultimately, it’s best to consult with a financial advisor to get the most accurate information, especially regarding Medicare Advantage plans and potential donut holes.

Examples of Plans with and without “Donut Holes”

| Plan Type | Description | Impact on Beneficiary Costs |

|---|---|---|

| Plan with “Donut Hole” | A plan that incorporates a “donut hole” structure for prescription drugs. This plan may have a lower monthly premium but higher out-of-pocket costs during the coverage gap. | Higher out-of-pocket costs during the “donut hole” phase. |

| Plan without “Donut Hole” | A plan that eliminates the “donut hole” structure for prescription drugs. This plan typically has a higher monthly premium but offers continuous coverage. | Lower out-of-pocket costs during higher-cost drug phases. |

Pros and Cons of Plans with and without a “Donut Hole”

- Plans with a “Donut Hole”:

Pros: Often have lower monthly premiums, allowing for greater flexibility in overall healthcare spending.

Cons: Out-of-pocket costs can be significantly higher during the “donut hole” phase. Beneficiaries need to carefully evaluate the total cost of care and plan for higher expenses during the coverage gap.

- Plans without a “Donut Hole”:

Pros: Provide continuous coverage at a consistent level, making drug costs more predictable. This predictability can help beneficiaries budget for their healthcare expenses.

Cons: Typically have higher monthly premiums. Beneficiaries must carefully weigh the higher premiums against the certainty of coverage.

Understanding the Differences in Coverage: Do All Medicare Advantage Plans Have A Donut Hole

Medicare Advantage plans offer a range of benefits beyond basic Medicare, including prescription drug coverage. However, the specifics of this coverage vary significantly between plans. Understanding these differences is crucial for beneficiaries to select a plan that best meets their individual needs and budget. Careful review of plan details is essential to avoid unexpected costs.A key aspect of evaluating a Medicare Advantage plan is comprehending the nuances of its prescription drug coverage.

This often involves a deeper dive into the plan’s specific formulary, which details the drugs covered, their cost-sharing, and any restrictions. A comprehensive understanding of the plan’s prescription drug coverage is vital to anticipate potential out-of-pocket expenses.

Finding Information About a Plan’s Prescription Drug Coverage

Medicare Advantage plans, unlike Original Medicare, typically include prescription drug coverage. To find information about a plan’s prescription drug coverage, beneficiaries should seek out the plan’s Summary of Benefits and Coverage (SBC) document.

Accessing the Plan’s Summary of Benefits and Coverage (SBC)

The Summary of Benefits and Coverage (SBC) is a standardized document outlining a Medicare Advantage plan’s benefits and costs. It’s a critical resource for evaluating a plan’s prescription drug coverage. This document is typically available on the plan’s website or through the Medicare website. Beneficiaries should look for the specific plan they are interested in.

Importance of Reviewing the SBC Document Carefully

Carefully reviewing the SBC document is essential. It details the plan’s formulary, which lists covered drugs, their cost-sharing, and any restrictions. Understanding these specifics is vital to determining the plan’s suitability for individual needs. The SBC should be carefully analyzed for coverage of specific medications.

Importance of Understanding Plan Specifics

Beyond the SBC, understanding specific plan details is crucial. Beneficiaries should be aware of factors like cost-sharing, copays, and deductibles for prescription drugs. Understanding the formulary’s tiers and cost-sharing percentages is important for budgeting. Additionally, understanding the plan’s network of pharmacies is important for cost and convenience.

Comparing and Contrasting Medicare Advantage Plans

| Plan Feature | Plan A (Example) | Plan B (Example) | Plan C (Example) |

|---|---|---|---|

| Formulary | Broad formulary, covers most common medications; Tiered pricing. | More limited formulary, may require prior authorization for certain drugs; Tiered pricing. | Narrow formulary, fewer drugs covered; Tiered pricing. |

| Copay | $10 for most generic drugs; $20 for brand name drugs. | $5 for most generic drugs; $30 for brand name drugs. | $25 for most generic drugs; $50 for brand name drugs. |

| Deductible | $500 annual deductible. | $1000 annual deductible. | $200 annual deductible. |

| Coverage Gaps | Limited coverage gaps. | Moderate coverage gaps. | Significant coverage gaps. |

Note: The table above is a simplified example and does not represent all possible variations. Actual plans may have different coverage details. Always refer to the plan’s specific Summary of Benefits and Coverage (SBC) for accurate information.

Final Thoughts

In summary, not all Medicare Advantage plans have a “donut hole” structure for prescription drugs, unlike Original Medicare’s Part D. Understanding the specific coverage details of each plan is paramount. This article has provided valuable insights into the nuances of Medicare Advantage plans and the donut hole, empowering you to make informed decisions about your healthcare coverage. Consult with a qualified professional for personalized advice.

Detailed FAQs

Does every Medicare Advantage plan have a separate donut hole?

No, not all Medicare Advantage plans have a “donut hole” structure identical to Original Medicare’s Part D. Some plans incorporate their own coverage structures for prescription drugs, which may or may not include a donut hole.

How can I find out if a specific Medicare Advantage plan has a donut hole?

Always review the plan’s Summary of Benefits and Coverage (SBC) document. This document details the specific coverage and cost-sharing arrangements for prescription drugs.

What are the key differences between Medicare Advantage and Original Medicare prescription drug coverage?

Medicare Advantage plans offer varying levels of prescription drug coverage, often including coverage outside the “donut hole” structure. Original Medicare’s Part D has a standardized “donut hole.” The out-of-pocket costs for prescription drugs will differ between the two options.

What factors influence the extent of prescription drug coverage in a Medicare Advantage plan?

Factors such as the specific plan, the type of coverage, and the drug itself will influence the level of prescription drug coverage and whether or not a plan has its own “donut hole” structure.