Term life and disability insurance are crucial for protecting your financial future. They provide different but essential safety nets, covering various aspects of life’s uncertainties. Understanding these policies can significantly impact your overall financial planning and help you make informed decisions about your needs and goals.

This comprehensive guide delves into the specifics of term life and disability insurance, outlining the types, benefits, costs, and considerations. It explores how these policies work together to create a comprehensive financial safety net. We’ll examine the different types of coverage, the premiums involved, and the claims process, empowering you to make the best choices for your unique situation.

Introduction to Term Life and Disability Insurance

Term life insurance and disability insurance are crucial components of a comprehensive personal financial plan. They protect your loved ones and your financial stability in the event of unexpected life events. Understanding their differences and overlapping needs can help you make informed decisions about your insurance coverage.

Key Differences and Similarities

Term life insurance provides temporary coverage for a specific period (e.g., 10, 20, or 30 years). If you die during that term, your beneficiaries receive a payout. Disability insurance, on the other hand, replaces a portion of your income if you become unable to work due to a covered disability. A key difference lies in the

duration* of coverage

term life is temporary, while disability insurance can be lifelong.

Overlapping Needs and Importance, Term life and disability insurance

Both term life and disability insurance address financial vulnerabilities during critical life stages. Term life insurance ensures financial security for your family if you pass away prematurely, while disability insurance safeguards your income and financial obligations should you become disabled. Both policies help maintain a stable financial future and protect your loved ones from financial hardship. Understanding these insurance types is essential for a robust financial plan, as they mitigate risks associated with loss of income and life.

Importance in Personal Financial Planning

Term life and disability insurance are vital components of a well-rounded financial plan. These policies safeguard your family’s financial well-being and ensure the stability of your personal obligations. Their importance is highlighted by considering the potential financial strain on loved ones if a primary income earner were to pass away or become disabled. The impact on long-term financial goals, like retirement planning, also underscores the importance of proactive financial planning.

Policy Comparison Table

| Policy Type | Coverage Amount | Premiums | Benefits |

|---|---|---|---|

| Term Life Insurance | $250,000 – $1,000,000+ (adjustable based on needs) | Generally lower than permanent life insurance for similar coverage amounts, but can vary based on age, health, and coverage duration. | Pays a lump sum to beneficiaries upon the insured’s death within the policy term. |

| Disability Insurance | Percentage of pre-disability income (e.g., 60%, 70%, 80%) | Depend on the type and extent of coverage, with monthly premiums for the policy. | Replaces a portion of lost income if the insured becomes disabled and unable to work. The specifics of the policy, such as the definition of disability, waiting periods, and maximum benefit duration, vary significantly between policies. |

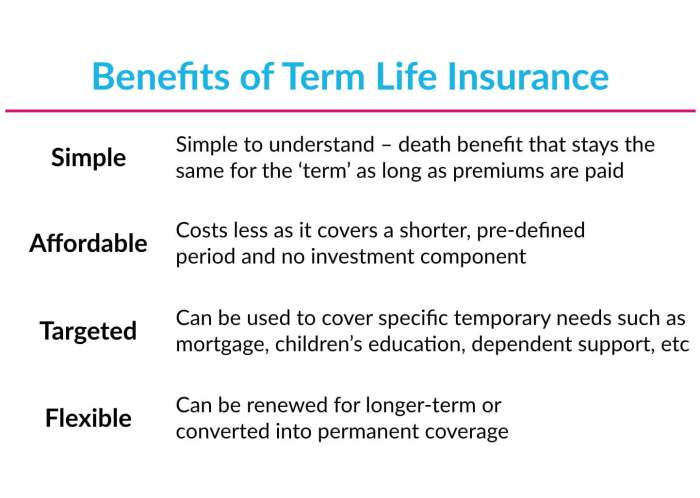

Types of Term Life Insurance

Term life insurance provides temporary coverage for a specific period, typically 10, 20, or 30 years. Understanding the different types is crucial for choosing the right policy to meet your needs and budget. This is vital because your needs and circumstances may change over time, impacting your insurance requirements.Term life insurance comes in various forms, each with its own characteristics and implications for your financial planning.

This allows you to choose a policy that aligns with your current financial situation and projected future needs.

Level Term Life Insurance

Level term life insurance offers a fixed death benefit and premium throughout the policy’s term. This provides consistent coverage and predictable payments, making budgeting easier. This stability is particularly beneficial for those who anticipate their needs remaining consistent over the policy’s duration. Premiums remain constant, which is important for long-term financial planning. For example, a 30-year-old purchasing a 20-year level term policy will pay the same premium each year for the entirety of the 20-year term.

Decreasing Term Life Insurance

Decreasing term life insurance provides a death benefit that decreases over time. The premiums are typically lower than those for level term insurance, reflecting the reduced coverage amount. This type is often suitable for individuals who have debts, such as a mortgage, that they want to secure. As the debt decreases, the coverage amount also decreases, making it a good fit for specific financial goals, like mortgage protection.

For example, if you take out a decreasing term life insurance policy to pay off a $200,000 mortgage, the death benefit will decrease as the mortgage balance declines.

Increasing Term Life Insurance

Increasing term life insurance offers a death benefit that grows over time, reflecting rising needs and expenses. This provides increasing coverage as your financial responsibilities may evolve over the policy term. This type is often chosen by individuals who anticipate future needs, such as raising children or building assets, and whose financial situation may change significantly. The premium is generally higher than that of a level term policy, but the increasing death benefit may be beneficial in the long run.

For example, a young professional may choose increasing term life insurance to cover the potential costs of raising a family.

Comparison Table

| Feature | Level Term | Decreasing Term | Increasing Term |

|---|---|---|---|

| Death Benefit | Fixed | Decreases | Increases |

| Premiums | Fixed | Lower | Higher |

| Coverage Amount | Constant | Decreases | Increases |

| Suitable for | Consistent needs | Debt protection | Growing needs |

Types of Disability Insurance

Disability insurance protects your income if you can’t work due to illness or injury. Understanding the various types available is crucial for choosing the right coverage. Different plans offer varying durations and conditions, ensuring you’re prepared for different life events.

Short-Term Disability Insurance

Short-term disability insurance provides income replacement for a limited period, typically ranging from a few weeks to several months. This coverage often kicks in after a waiting period, which can vary from 14 to 21 days. This type is frequently used for temporary illnesses or injuries that prevent you from working.

- Benefits: Provides a crucial safety net during short-term absences from work, helping you cover essential expenses. It can be a significant financial buffer during periods of recuperation.

- Limitations: Covers a shorter period than long-term disability. The benefit amount is often a percentage of your pre-disability income.

- Waiting Period: A significant factor in short-term disability is the waiting period. This is the time between the onset of the disability and when benefits begin. A shorter waiting period will allow you to start receiving payments sooner.

Long-Term Disability Insurance

Long-term disability insurance steps in when your short-term disability runs out. It replaces a portion of your income for an extended period, potentially lasting years, even until retirement. A longer waiting period is usually involved, ranging from 90 days to 1 year.

- Benefits: Provides a continuous income stream during extended periods of disability, allowing you to maintain financial stability. Crucially important for those with long-term illnesses or injuries.

- Limitations: Often comes with stricter eligibility requirements compared to short-term disability. The benefit amount is a percentage of your pre-disability income, and coverage can be limited by certain conditions.

- Waiting Period: Longer waiting periods than short-term, and this delay can impact your ability to receive financial assistance during the critical initial recovery phase. This can also affect your overall financial well-being.

Specific Occupation Disability Insurance

This specialized coverage targets individuals with professions that present unique risks or conditions that could cause disability. Examples include construction workers or firefighters.

- Benefits: Tailored coverage addresses risks associated with specific occupations, which is beneficial to those with high-risk professions. It offers higher levels of coverage for injuries related to their occupation.

- Limitations: Can be more expensive than standard disability insurance, and the benefit amount can vary. This is because of the inherent risks and needs of these professions.

- Waiting Period: Generally, specific occupation policies have similar waiting periods to standard long-term disability plans.

Coverage Amounts and Waiting Periods

The amount of coverage and waiting periods are critical factors. Coverage amounts are often a percentage of your pre-disability income. Waiting periods vary depending on the type of policy.

Pre-Existing Conditions

Pre-existing conditions can impact eligibility for disability insurance. Policies often exclude coverage for conditions diagnosed before the policy is purchased. It’s crucial to understand the specific conditions under your plan’s exclusions.

| Type of Disability Insurance | Coverage Duration | Waiting Period | Coverage Amount | Eligibility |

|---|---|---|---|---|

| Short-Term | Weeks to months | 14-21 days | Percentage of pre-disability income | Generally broader eligibility |

| Long-Term | Years | 90 days-1 year | Percentage of pre-disability income | More stringent eligibility criteria |

| Specific Occupation | Years | 90 days-1 year | Percentage of pre-disability income | Addresses risks of specific professions |

Benefits and Coverage Options

Term life and disability insurance offer crucial financial protection, safeguarding your loved ones and your livelihood. Understanding the specific benefits and coverage options is vital for making informed decisions. Careful consideration of coverage amounts, exclusions, and premium costs is essential for selecting policies that align with your needs and budget.

Term Life Insurance Benefits

Term life insurance primarily provides a death benefit to your beneficiaries upon your passing. This payout helps cover outstanding debts, funeral expenses, and support your family’s financial needs. Some policies include an accidental death benefit, offering an additional payout in the event of an accidental death. This additional coverage can significantly enhance the financial security provided to your beneficiaries.

Disability Insurance Benefits

Disability insurance aims to replace lost income due to an inability to work. Common benefits include income replacement, designed to cover a percentage of your pre-disability income. Some policies also offer specific illness coverage, addressing medical conditions that may not qualify for standard disability benefits. A thorough understanding of these different benefit types and potential exclusions is crucial.

Coverage Denials

Coverage denials can occur due to pre-existing conditions, fraudulent claims, or failure to meet policy requirements. It’s crucial to carefully review policy terms and understand the specific circumstances under which coverage might be denied. Honest and complete disclosure during the application process is paramount for avoiding potential denials.

Financial Implications

The financial implications of these policies are multifaceted. Premiums vary based on factors like age, health, and coverage amounts. The death benefit or income replacement amount can be substantial, providing a safety net for your loved ones. Conversely, if you don’t need or use the coverage, the premiums you pay might not provide a significant return on investment.

Term life and disability insurance are crucial for protecting your financial future. Finding reputable insurance companies, like those in Jackson, MS, is key to securing the right coverage. Insurance companies in Jackson ms offer a variety of options, but ultimately the best choice depends on individual needs and circumstances. Choosing the right policy remains vital for comprehensive financial protection.

Coverage Comparison Table

| Coverage Type | Premium Amount (Example) | Benefits | Exclusions |

|---|---|---|---|

| Term Life Insurance (10-year term, $500,000 coverage) | $200-$400 per year | $500,000 payout to beneficiaries upon death. Accidental death benefit may be available as an add-on. | Suicide (within the first 2 years of policy), intentional self-harm, or certain risky activities. |

| Disability Insurance (60% income replacement, 2-year waiting period) | $200-$600 per month | 60% of pre-disability income, up to a maximum amount, paid monthly during disability. Specific illness coverage may be included as an add-on. | Pre-existing conditions not disclosed, intentional self-inflicted injury, occupational diseases related to your job. |

Factors to Consider When Choosing

Choosing the right term life and disability insurance is crucial for financial security. It involves careful consideration of your individual circumstances, goals, and potential risks. Understanding the factors that influence your decisions can lead to a more suitable and effective insurance strategy.

Coverage Amount Considerations

Determining the appropriate coverage amount for term life insurance depends on several key factors. Family needs, income level, and outstanding debts are critical components. A larger family, higher income, and substantial debts necessitate a higher coverage amount. For instance, a family with two children and a mortgage might require a higher life insurance policy to ensure their financial stability in case of a primary breadwinner’s death.

Similarly, individuals with substantial student loan debt or other significant financial obligations may need higher coverage to protect their loved ones from potential financial hardship.

Premium Costs and Policy Terms

Premium costs and policy terms are vital factors in the decision-making process. Higher coverage amounts often correlate with higher premiums. Understanding the interplay between premium costs and policy terms is crucial. The length of the policy term also affects premiums, with longer-term policies generally leading to higher premiums. This is because longer-term policies cover a larger portion of your life and potentially greater risks.

For example, a 20-year term life insurance policy will have a different premium structure than a 10-year policy. Choosing a policy term that aligns with your financial plan and future goals is essential.

Short-Term vs. Long-Term Disability Insurance

The choice between short-term and long-term disability insurance hinges on individual circumstances. Short-term disability insurance typically provides benefits for a limited period (e.g., 6 to 12 months) and covers temporary disabilities. Conversely, long-term disability insurance offers benefits for an extended period (e.g., 2 years or more) and caters to long-term illnesses or injuries that hinder one’s ability to work.

Individuals with high-risk professions or chronic health conditions might opt for long-term coverage. Consider a scenario where a construction worker experiences a severe injury requiring extensive rehabilitation. Long-term disability insurance would offer financial support during the recovery period.

Importance of Consulting a Financial Advisor

Seeking guidance from a qualified financial advisor is highly recommended. A financial advisor can provide personalized recommendations based on your unique circumstances, assessing your income, expenses, debts, and family situation. They can evaluate various insurance options and tailor a strategy that aligns with your financial goals. They can also explain complex insurance policies in a simple way, helping you make informed decisions.

Securing term life and disability insurance is crucial for financial stability, especially when considering major life events. Planning for unexpected circumstances like a trip, such as taking a scenic tour from Seattle to Vancouver, tours from seattle to vancouver , can also benefit from such foresight. This careful planning extends beyond vacations, highlighting the importance of these insurance policies for overall peace of mind.

Key Factors to Consider

| Factor | Description |

|---|---|

| Family Needs | Consider the financial needs of your family, including dependents and outstanding debts. |

| Income Level | Evaluate your current and projected income to determine the appropriate coverage amount. |

| Outstanding Debts | Account for outstanding debts such as mortgages, student loans, and credit card balances. |

| Premium Costs | Analyze the costs associated with different policy terms and coverage amounts. |

| Policy Term | Choose a policy term that aligns with your financial plan and future goals. |

| Type of Disability | Consider the nature of potential disabilities and the duration of required coverage. |

| Financial Advisor Consultation | Seek professional guidance to tailor a strategy that meets your specific needs. |

Comparison of Term Life and Disability Insurance

Term life and disability insurance are crucial tools for safeguarding your financial well-being. Understanding their distinct benefits, potential costs, and how they can complement each other is essential for making informed decisions. Both policies offer different levels of protection, catering to various life stages and needs.This comparison will help you evaluate which policy best aligns with your circumstances, and how they can work together to build a comprehensive protection plan.

Benefits Comparison

Term life insurance primarily provides a death benefit to your beneficiaries, ensuring financial security for your loved ones if the unexpected occurs. Disability insurance, on the other hand, offers a regular income if you become unable to work due to illness or injury. This income replacement can help maintain your lifestyle and financial obligations.

Scenarios for Optimal Use

Term life insurance is particularly beneficial for individuals with dependents, protecting their financial future in the event of premature death. A young family with a mortgage and children would strongly benefit from term life insurance. Disability insurance is ideal for individuals with substantial debt or those who rely on their income for essential expenses. Someone with a high-paying job and significant financial obligations would benefit from disability insurance.

Costs and Drawbacks

Term life insurance premiums are generally lower than those for permanent life insurance, especially for younger, healthier individuals. However, these premiums can increase as you age. Disability insurance premiums can vary significantly based on factors like your occupation, health, and the coverage amount. The potential drawback is that you may not receive any payout if you aren’t unable to work for the length of time stipulated by the policy.

Using Policies Together

Combining term life and disability insurance can provide a robust financial safety net. Term life insurance ensures financial support for your family in case of death, while disability insurance provides income replacement if you’re unable to work. This dual protection strategy addresses both the potential loss of income and the financial burden on loved ones in unforeseen circumstances.

Key Feature Comparison

| Feature | Term Life Insurance | Disability Insurance |

|---|---|---|

| Primary Benefit | Financial security for beneficiaries in case of death | Income replacement in case of disability |

| Premium Structure | Generally lower premiums, especially for younger individuals | Premiums vary widely based on factors like occupation and health |

| Coverage Duration | Typically for a set period (e.g., 10, 20, or 30 years) | Can be for a lifetime or a specific duration |

| Coverage Trigger | Death of the insured | Inability to work due to illness or injury |

| Potential Drawbacks | Premiums may increase as you age; no coverage after policy expires | No payout if unable to work for the stipulated time; policy exclusions |

| Best Use Cases | Protecting dependents; providing a financial cushion for family | Maintaining lifestyle during disability; covering debt and expenses |

Policy Costs and Premiums

Term life and disability insurance premiums aren’t a one-size-fits-all figure. Understanding how these costs are calculated is key to making informed decisions. Premiums vary based on numerous factors, influencing the affordability and suitability of coverage.Premiums are the regular payments you make to maintain your insurance policy. They are calculated using complex actuarial models, taking into account numerous factors.

These models estimate the likelihood of certain events, such as death or disability, and use this data to establish a fair and sustainable premium structure.

Premium Determination

Premium calculations are not arbitrary; they are based on statistical analysis and actuarial science. Insurers use extensive data to determine the probability of a policyholder experiencing a covered event (death or disability). Factors such as age, health, lifestyle choices, and the desired coverage amount are all integrated into these calculations.

Factors Affecting Premium Rates

Several factors significantly influence premium rates. These factors can make a policy more or less expensive. These factors are critical to understanding when comparing policies.

- Age: As you get older, your risk of death or disability increases, which directly correlates with higher premiums. This is a key factor to consider when choosing a policy, as age often dictates the cost. Younger individuals will typically pay lower premiums for the same coverage.

- Health: Pre-existing health conditions and lifestyle choices (e.g., smoking, poor diet) can increase the likelihood of a covered event. Insurance companies assess this risk through medical evaluations and questionnaires, directly influencing the premium amount. Individuals with pre-existing conditions may experience higher premiums.

- Coverage Amount: Higher coverage amounts naturally lead to higher premiums, as the insurer assumes a greater financial risk. Larger policies typically result in larger premium payments.

- Policy Type: Different types of term life insurance (e.g., level term, decreasing term) and disability insurance (e.g., short-term, long-term) have varying premium structures. Level term premiums remain consistent throughout the policy term, while decreasing term policies have premiums that decrease over time.

- Policy Duration: The length of the policy term affects the premium. Longer-term policies often involve higher premiums due to the extended period of coverage.

Policy Costs and Coverage Amounts

A direct relationship exists between the amount of coverage and the premium. More substantial coverage requires larger premiums to compensate for the increased financial risk. A simple example would be that a $500,000 term life policy would have higher premiums than a $250,000 policy.

| Age | Health | Coverage Amount (Term Life) | Estimated Monthly Premium (Term Life) | Coverage Amount (Disability) | Estimated Monthly Premium (Disability) |

|---|---|---|---|---|---|

| 30 | Good | $500,000 | $50-$75 | $5,000 monthly | $30-$50 |

| 40 | Fair | $500,000 | $75-$100 | $5,000 monthly | $40-$60 |

| 50 | Good | $500,000 | $100-$150 | $5,000 monthly | $50-$75 |

Note: These are estimated premiums and can vary significantly based on the specific insurance provider, policy terms, and other factors.

Claims Process and Procedures: Term Life And Disability Insurance

Navigating the claims process for term life and disability insurance can feel daunting. Understanding the steps involved and the necessary documentation beforehand can ease this anxiety. This section details the procedures for filing and processing claims, outlining potential issues and providing examples.

Filing a Term Life Insurance Claim

The process for filing a term life insurance claim typically involves several key steps. First, you must notify the insurance company of the death of the insured. This notification should include the date of death, the insured’s full name, policy number, and contact information. Gathering supporting documentation is crucial for a smooth claim process. This includes the death certificate, proof of the insured’s identity, and any other documents requested by the insurance company.

Documents Required for a Term Life Insurance Claim

A comprehensive list of documents is essential for a successful term life insurance claim. These documents typically include:

- Death certificate

- Policy documents (including the policy number and name of the insured)

- Proof of identity for the claimant (e.g., driver’s license, passport)

- Beneficiary designation (if applicable)

- Proof of relationship to the deceased (if the claimant is not the named beneficiary)

- Other supporting documentation as requested by the insurance company (e.g., medical records if the cause of death is unclear).

Timeline for Processing Term Life Insurance Claims

The timeline for processing a term life insurance claim varies depending on the insurance company and the complexity of the case. Insurance companies typically have a standard timeframe for reviewing claims, but this can be extended in certain situations. Factors influencing the timeline include the completeness of the submitted documentation and any necessary investigations. A typical timeline may range from a few weeks to several months.

Potential Issues in the Term Life Insurance Claims Process

Potential complications in the claims process can arise from incomplete or inaccurate documentation. For example, if the death certificate is missing vital information or if the beneficiary designation is unclear, the process could be delayed. Discrepancies in the insured’s identity or conflicting beneficiary claims can also create challenges. Thorough preparation and clear communication can help mitigate these potential issues.

Filing a Disability Insurance Claim

The process for filing a disability insurance claim is generally similar to a life insurance claim, but it involves different documentation and considerations. The insured must provide proof of their disability and the extent of the impact on their ability to work. The claim should include details about the disabling condition, the date of onset, and the supporting medical documentation.

Documents Required for a Disability Insurance Claim

The necessary documents for a disability insurance claim often include:

- Physician’s statement(s) describing the disability

- Medical records detailing the medical condition

- Proof of the inability to perform work duties

- Policy documents (including the policy number and name of the insured)

- Documentation from employers, if applicable

- A completed claim form

Timeline for Processing Disability Insurance Claims

The timeframe for processing a disability insurance claim can vary based on the insurer and the specifics of the case. Claims involving complex medical evaluations or multiple medical opinions may take longer. Generally, the insurance company will have a specific process and timeline for reviewing the submitted documentation and evidence.

Potential Issues in the Disability Insurance Claims Process

Potential issues in disability insurance claims often stem from difficulties in proving the extent of disability or in providing consistent and comprehensive medical documentation. Delays may occur if the medical records are incomplete or if the claimant’s ability to work is not adequately documented. Understanding the specific requirements of the insurance policy and the necessary documentation is crucial to avoid delays and complications.

Claims Process Summary Table

| Step | Term Life Insurance | Disability Insurance |

|---|---|---|

| 1. Notification of Event | Notify company of death | Notify company of disability onset |

| 2. Gather Documents | Death certificate, policy, beneficiary info | Medical records, physician statements, proof of inability to work |

| 3. Submit Claim | Complete claim form, submit documents | Complete claim form, submit documents |

| 4. Review and Evaluation | Insurance company assesses claim | Insurance company assesses claim and medical records |

| 5. Decision | Approve or deny claim | Approve or deny claim |

Closure

In conclusion, term life and disability insurance are powerful tools for safeguarding your financial well-being. By carefully considering your individual needs and goals, you can select the right coverage and make informed decisions that protect your family and future. Understanding the complexities of these policies, and their potential costs, is key to making the best choice for your situation.

Remember, consulting a financial advisor is highly recommended for personalized advice.

FAQ Summary

What’s the difference between term and permanent life insurance?

Term life insurance provides coverage for a specific time period, while permanent life insurance offers lifelong coverage. Term life is generally less expensive, while permanent life insurance builds cash value.

How much disability insurance do I need?

The amount of disability insurance you need depends on your income and expenses. Aim for a policy that replaces a significant portion of your income in case of disability.

What if I have a pre-existing medical condition?

Some disability insurance policies may exclude or limit coverage for pre-existing conditions. It’s crucial to carefully review the policy details and understand any exclusions.

How do I file a claim for disability insurance?

The process varies by insurer. Generally, you’ll need to provide medical documentation and follow the insurer’s specific claim procedures.