Central bank gift card balance: Understanding how these cards work, accessing your balance, and staying secure is crucial. This guide covers everything from basic definitions to international considerations and future trends, providing a comprehensive overview of central bank gift cards.

Whether you’re a frequent user or just curious about this innovative payment method, this resource offers a straightforward approach to understanding central bank gift cards and their associated balances. From the practical aspects of checking your balance to the security precautions you should take, we’ve got you covered.

Understanding the Concept

Central bank gift cards, while not a common term, represent a potential avenue for financial transactions. Understanding their function, potential uses, and associated risks is crucial for anyone considering their application. This section details the concept of central bank gift cards, clarifying their nature and exploring their practical implications.Central bank gift cards, if they exist, are likely to be a type of electronic payment instrument.

They differ from traditional gift cards in their potential for wider use and backing by a central banking institution. The purpose and function of such a card would be to facilitate transactions and potentially offer specific advantages in the financial system.

Definition of a Central Bank Gift Card Balance

A central bank gift card balance, if implemented, would represent a pre-loaded amount of funds on a digital card linked to a central banking system. This balance is intended to be used for various transactions, akin to a debit card, but with a predetermined value and potential restrictions.

Purpose and Function, Central bank gift card balance

The primary purpose of a central bank gift card would be to facilitate secure and efficient transactions, potentially replacing or supplementing existing payment methods. Its function would be to allow for the transfer of funds in a controlled environment, perhaps for specific government programs or designated businesses.

Typical Use Cases

Potential use cases for a central bank gift card could include government-funded programs, employee benefits, or specific economic stimulus initiatives. For instance, they could be used to pay for goods and services within a designated network or for specific purchases within a government-sponsored program.

Types of Central Bank Gift Cards

Currently, there is no widely recognized categorization of central bank gift cards. If such cards were introduced, they could potentially be differentiated based on their intended use, access limitations, or the specific programs they support. Possible variations may include cards for specific government initiatives or cards linked to specific businesses or sectors.

Benefits of Access to a Central Bank Gift Card Balance

Potential benefits could include greater security for transactions, reduced reliance on cash, and the ability to offer specialized incentives for specific populations or programs. For instance, they could enhance the efficiency of government programs by offering a secure and traceable payment method.

Risks Associated with a Central Bank Gift Card Balance

Potential risks associated with a central bank gift card balance could include security vulnerabilities, if not implemented and managed properly, and potential issues with access restrictions. Implementing proper security measures and having clear guidelines for use are critical to mitigate these risks.

Access and Management

Managing your central bank gift card balance is straightforward and efficient. This section details the process for checking and managing your card, providing various access methods and examples of available tools. Understanding these procedures ensures you can effectively utilize your gift card for its intended purpose.Accessing and managing your central bank gift card balance is crucial for responsible financial use.

By following the steps Artikeld below, you can easily track your card’s available funds and make informed spending decisions.

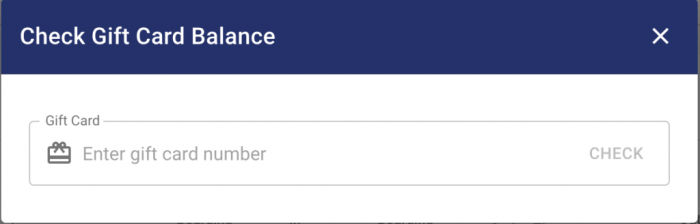

Checking Your Balance

A variety of methods allow you to check your central bank gift card balance, catering to different preferences and situations. This section Artikels the common methods available.

- Online Portal: Many central banks provide a dedicated online portal for checking gift card balances. This portal often features a secure login system and a dashboard displaying the current balance. Access to the online portal typically requires the card’s associated account details or a unique identification number.

- Mobile Application: A mobile application is another convenient option. This application, often available for both iOS and Android devices, provides a user-friendly interface for viewing the balance in real time. The application frequently offers additional features like transaction history and notifications.

- Phone Call: For those who prefer a phone call, many central banks offer customer support lines. Contacting customer support allows you to request your balance through a phone call and receive the information verbally. The customer support line typically operates during specific business hours.

Managing Your Balance

Effective management of your central bank gift card balance involves understanding the various features and options available. This includes tracking your spending, understanding any restrictions, and utilizing any available tools.

Examples of Online Tools

Several online tools and platforms facilitate the management of your gift card balance. These platforms usually provide a detailed transaction history and allow for managing funds.

- Central Bank Website: The official website of the central bank often houses a dedicated section for gift cards, including online access to your balance and transaction history. This direct access is usually secure and offers up-to-date information.

- Third-Party Financial Management Apps: Many financial management applications offer features for linking gift cards. This integration allows for tracking gift card spending alongside other financial accounts. These apps frequently provide budgeting tools and expense categorization, enabling a comprehensive overview of your spending.

Methods to Access Balance

The following table summarizes the various methods for accessing your gift card balance.

| Method | Description |

|---|---|

| Online Portal | Access your balance via a secure online platform. |

| Mobile App | Check your balance through a dedicated mobile application. |

| Phone Call | Contact customer support to obtain your balance verbally. |

Security and Fraud Prevention

Protecting your central bank gift card balance is paramount. Robust security measures are in place to safeguard your funds and prevent fraudulent activities. This section details the security protocols, potential fraud scenarios, and procedures for handling lost or stolen cards. Understanding these precautions empowers you to maintain the security of your gift card balance.

Security Measures in Place

Central banks employ a multi-layered approach to protect gift card balances. This includes encryption of data during transactions, regular security audits, and the use of advanced fraud detection systems. These measures are continuously refined to adapt to evolving threats. Strong authentication methods, like multi-factor authentication, are increasingly implemented to further enhance security.

Potential Fraud Scenarios

Several scenarios can lead to fraudulent activity related to central bank gift cards. Phishing attempts, where fraudsters impersonate legitimate entities to obtain sensitive information, are a significant concern. Other threats include stolen gift cards, compromised accounts, and identity theft. It is important to remain vigilant and avoid suspicious communications.

Procedures for Reporting Lost or Stolen Gift Cards

Central banks have clear procedures for reporting lost or stolen gift cards. Immediate reporting is crucial to minimize potential losses. Contacting the designated support channels, as Artikeld in the card’s terms and conditions, is vital. This allows the bank to promptly block the card and prevent unauthorized access.

Importance of Strong Passwords and Security Questions

Strong passwords and security questions are essential for protecting your account. Use a combination of uppercase and lowercase letters, numbers, and symbols. Avoid easily guessable passwords, like your birthday or pet’s name. Choose security questions with answers only you know. Regularly updating your password and security details is recommended.

Identifying and Avoiding Phishing Attempts

Phishing attempts are a common threat. Be wary of unsolicited emails, text messages, or phone calls requesting your gift card information. Verify the authenticity of any communication by directly contacting the central bank through official channels. Avoid clicking on links from unknown sources. Legitimate institutions will never ask for your gift card PIN or other sensitive information via email or text.

Comparison of Security Protocols

| Central Bank | Primary Security Protocol | Secondary Security Protocol | Additional Measures |

|---|---|---|---|

| Bank A | Advanced Encryption Standard (AES) | Multi-factor authentication | Regular security audits, fraud monitoring system |

| Bank B | Two-factor authentication | Token-based authentication | Transaction monitoring, customer education programs |

| Bank C | Biometric authentication | Transaction monitoring | Regular security updates, dedicated fraud team |

Note: This table provides examples of security protocols and is not exhaustive. Specific protocols may vary depending on the central bank.

Terms and Conditions

Central bank gift cards, while offering a convenient and secure payment method, come with specific terms and conditions. Understanding these rules is crucial for responsible use and avoiding potential issues. This section details the common stipulations associated with these cards.Gift cards, like other financial instruments, are governed by a set of rules to ensure fair usage and prevent abuse.

These terms and conditions define the parameters within which the gift card operates, outlining acceptable transactions and prohibiting fraudulent activities. These rules are designed to protect both the cardholder and the issuing institution.

Restrictions and Limitations

Gift cards often have restrictions on the types of goods or services they can be used for. For example, some cards might not be usable at certain retail locations or online platforms. These restrictions ensure the gift card’s value is maintained and prevent its use for inappropriate purposes.

- Geographic limitations: Some cards may only be usable within a specific region or country.

- Merchant restrictions: Cards may not be usable at certain stores or online retailers.

- Minimum purchase amounts: Some retailers may require a minimum purchase amount to use the gift card.

- Type of goods or services: Certain cards might be restricted for specific types of purchases (e.g., excluding certain categories of goods or services).

Expiry Date Policy

Gift cards typically have an expiry date, after which the remaining balance becomes unusable. This policy ensures the card’s value is managed and prevents the accumulation of unused funds over an extended period. It also helps to prevent potential fraud.

- Varying expiry dates: Expiry dates for gift cards can vary depending on the issuing institution and the specific card.

- Notification mechanisms: Issuing institutions usually provide notification of the expiry date to cardholders.

- Possible exceptions: Some cards may offer extensions to expiry dates under certain conditions.

Dispute Resolution Process

A clear dispute resolution process is essential for handling any discrepancies or issues related to gift card balances. This process ensures a fair and efficient resolution of complaints.

While central bank gift card balances offer a tempting financial cushion, securing a stable future often involves practical considerations like finding suitable housing. For instance, exploring 2 bedroom houses for sale near me 2 bedroom houses for sale near me could provide a solid foundation for long-term financial planning, complementing the potential of a central bank gift card balance.

Ultimately, prudent financial management requires a comprehensive strategy.

- Contacting customer support: Cardholders can contact the issuing institution’s customer support to report any issues.

- Documentation requirements: Providing supporting documentation, such as receipts or transaction records, is often necessary for resolving disputes.

- Timelines for resolution: The resolution process usually follows established timelines to ensure timely action.

Comparison of Terms and Conditions

Comparing terms and conditions across different central banks’ gift card programs can help users make informed choices. Variations in restrictions, expiry dates, and dispute resolution procedures may exist. Carefully reviewing these details is crucial for choosing the most suitable gift card.

Hypothetical Central Bank Gift Card Program

| Feature | Description |

|---|---|

| Card Name | Example: “Central Bank Premier Gift Card” |

| Minimum Balance | No minimum balance required |

| Expiry Date | 3 years from date of issuance |

| Geographic Restrictions | Usable in all participating countries |

| Merchant Restrictions | No restrictions; usable at all participating merchants |

| Dispute Resolution | Contact customer service within 90 days of the transaction |

Gift Card Value and Usage

Central bank gift cards offer a secure and convenient way to make payments. Understanding their value, denominations, and usage limitations is crucial for responsible management. This section delves into the specifics of these gift cards, highlighting their unique characteristics and how they compare to other gift card options.Central bank gift cards, issued by a central bank, function similarly to other gift cards but hold specific value and usage limitations due to their institutional backing.

These cards are designed for specific purposes, with different denominations and limitations on how they can be used.

Gift Card Denominations

Central bank gift cards come in various denominations, reflecting the diverse needs of users. These denominations are carefully selected to support a range of transactions. The specific denominations available may vary depending on the issuing central bank.

Gift Card Value and Balance

The value of a central bank gift card is directly tied to its balance. The balance represents the monetary amount loaded onto the card, which can be used for eligible transactions. The balance on the card is the exact amount of money available for spending.

Gift Card Usage

Central bank gift cards can be used for specific transactions, often restricted to particular merchants or categories of goods and services. This restriction helps maintain the integrity of the central bank’s financial system. The card is typically used to make payments at authorized locations.

Limitations of Central Bank Gift Card Usage

Central bank gift cards often have limitations on their usage, including restrictions on merchants, transaction types, and geographical locations. These limitations are put in place to prevent misuse and ensure the gift cards are used as intended. The cards may also have expiry dates, after which the remaining balance is lost.

Comparison with Other Gift Cards

Central bank gift cards differ from other gift cards in terms of their value, usage, and security. They are often more secure and offer a more regulated payment system. They may have a lower number of participating merchants than general-purpose gift cards, but often come with guaranteed value. The usage limitations may vary based on the issuing institution.

Gift Card Usage Scenarios

| Scenario | Transaction | Gift Card Balance (USD) | Result |

|---|---|---|---|

| Purchase of Goods | Buying groceries at a designated supermarket | $50 | Successful transaction; balance reduced to $0. |

| Payment for Services | Paying for electricity bill at a designated payment portal | $100 | Successful transaction; balance reduced by the bill amount. |

| Ineligible Transaction | Paying for a movie ticket at a cinema | $25 | Transaction declined; card balance remains unchanged. |

International Considerations

Gift cards issued by central banks can offer unique advantages for international transactions, but their use is influenced by various factors specific to each country. Understanding these nuances is crucial for users considering these cards for cross-border payments. International differences in regulations, exchange rate policies, and local payment systems affect the usability and value of these cards.

Differences in Gift Card Programs Across Countries

Central bank gift card programs vary significantly across countries. These differences stem from differing national payment systems, regulatory frameworks, and economic policies. Some countries might prioritize digital gift cards while others may favor physical cards. These variations can impact the card’s functionality, usability, and acceptance.

Comparison of Terms and Conditions

The terms and conditions of central bank gift card programs differ significantly across countries. Restrictions on usage, expiration dates, and maximum transaction amounts can vary considerably. Some cards might have limitations on international transactions, while others may not. Understanding these conditions is essential to avoid unexpected fees or limitations.

Exchange Rate Implications

Exchange rate fluctuations can significantly impact the value of a central bank gift card when used internationally. Conversion rates applied by different payment processors or financial institutions can influence the final amount received or spent. This fluctuation can affect the overall value of the gift card.

Impact of Local Regulations

Local regulations can impact the use of central bank gift cards in different countries. For example, some countries may have restrictions on the use of foreign currency or the acceptance of foreign payment methods. These regulations might influence how the gift card can be utilized in local businesses or online platforms.

Examples of Specific Central Bank Gift Card Programs

Several countries have introduced central bank gift card programs, though the specifics vary. For instance, the [Country A] central bank might offer a gift card that allows for direct exchange with the national currency. Another example is [Country B] where the central bank gift card is widely accepted in both online and offline retail. These programs reflect national economic and social conditions.

Table Comparing Features of Central Bank Gift Card Programs

| Country | Card Type | International Usage | Exchange Rate | Local Regulations |

|---|---|---|---|---|

| Country A | Digital & Physical | Limited to certain merchants | Fixed exchange rate on certain platforms | No restrictions on foreign currency use in specific cases |

| Country B | Digital | Widely accepted | Dynamic exchange rate determined by processor | Restrictions on foreign currency use exist |

| Country C | Physical | Limited acceptance | Variable exchange rate depending on merchant | Regulations on accepting foreign currency |

Future Trends: Central Bank Gift Card Balance

Central bank gift cards, while still a relatively nascent concept, hold significant potential for shaping the future of digital finance. Their adoption and evolution will depend on several key factors, including technological advancements, the growth of digital currencies, and the potential for integration with other financial services. This section explores these potential future trends.

Potential Developments in Central Bank Gift Card Technology

Central bank gift card technology is likely to become more sophisticated and user-friendly. Expect advancements in mobile wallets, biometric authentication, and enhanced security protocols. This will enhance the user experience, making transactions smoother and more secure. Integration with existing payment systems and platforms is also anticipated, allowing for seamless transitions and reducing friction for users. Real-time transaction processing and instant balance updates will become standard features, improving efficiency and convenience.

Role of Digital Currencies in the Future of Central Bank Gift Cards

Digital currencies, such as central bank digital currencies (CBDCs), are poised to play a significant role in the future of central bank gift cards. CBDCs could potentially underpin the gift card system, enhancing its security and stability. This integration could also provide a framework for more efficient and secure cross-border transactions, facilitating international use cases for these gift cards.

For example, if a central bank gift card is backed by a CBDC, it could be used in different countries without significant currency exchange fees or delays.

Integration with Other Financial Services

Central bank gift cards have the potential to integrate with other financial services, creating a more holistic financial ecosystem. This could include linking gift card balances to savings accounts or investment platforms. For instance, users might be able to transfer funds from their gift card balance to their savings account or use it as collateral for a loan.

This integration could offer users more financial options and encourage broader adoption of central bank gift cards.

Recent fluctuations in central bank gift card balances might indicate a potential surge in consumer spending. This could translate to increased patronage at establishments like restaurant le p’tit jeannot , a local favorite known for its delectable cuisine. However, further analysis is needed to definitively link the gift card balance to specific spending patterns.

Impact on Financial Inclusion

Central bank gift cards have the potential to significantly enhance financial inclusion, particularly in underserved communities. They can provide a secure and accessible way to send and receive funds, eliminating the need for physical cash transactions or reliance on traditional banking services. This is especially important in regions where access to traditional banking infrastructure is limited. For example, they can enable micro-transactions, facilitating access to services and goods, which is beneficial in developing economies or for individuals lacking formal financial accounts.

Epilogue

In conclusion, central bank gift cards offer a unique financial instrument with various benefits and potential risks. Understanding the different aspects of these cards, from balance management to security measures, is key to maximizing their utility. This guide has provided a detailed overview to empower you to make informed decisions regarding central bank gift cards and their balances.

FAQ Guide

What are the typical denominations of central bank gift cards?

Denomination amounts vary by issuing central bank. Some common denominations are likely to be multiples of a base unit, allowing for a range of value options.

Can I use a central bank gift card internationally?

International use is possible but exchange rates and local regulations may affect the value and usage.

How do I report a lost or stolen central bank gift card?

Contact the issuing central bank immediately. Follow their specific reporting procedures.

What are some common restrictions on using central bank gift cards?

Restrictions vary by issuing central bank. Some examples might include transaction limits, expiration dates, or specific merchant acceptance.